The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to employers who hire certain groups of Americans, including veterans, who have historically faced problems finding decent jobs.

The credit is designed to help groups such as disabled veterans, those receiving public assistance, disadvantaged youth and others. The credit ranges from $2,400 to $9,600, depending on the new hire's wages and which targeted group the employee was hired from.

Currently a veteran is qualified as a targeted group hire if they are:

- Unemployed for a total of at least 4 weeks in the year preceding the hire.

- A disabled veteran who has been out of the military for less than one year.

- A member of a family receiving Supplemental Nutrition Assistance Program - SNAP (food stamps) for at least 3 months during the first 15 months of employment.

- A disabled veteran participating in a state or federal vocational rehabilitation program.

To see the complete list of targeted groups visit the IRS website.

The WOTC is authorized until Dec. 31, 2025.

For more details visit the Department of Labor's website.

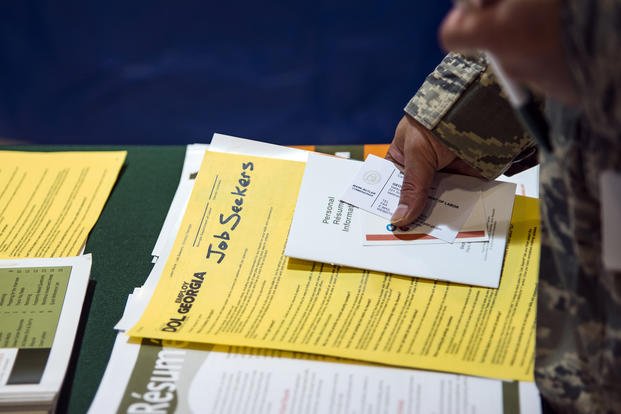

Find the Right Veteran Job

Whether you want to polish your resume, find veteran job fairs in your area or connect with employers looking to hire veterans, Military.com can help. Subscribe to Military.com to have job postings, guides and advice, and more delivered directly to your inbox.