A U.S. government shutdown began Wednesday after after lawmakers deadlocked and missed the deadline for funding the government. Hundreds of thousands of federal workers face furloughs and many offices will close.

Here’s what to know about the shutdown:

What happens in the shutdown?

Now that a lapse in funding has occurred, the law requires agencies to furlough their “non-excepted” employees. Excepted employees, who include those who work to protect life and property, stay on the job but don’t get paid until after the shutdown ends.

The White House Office of Management and Budget begins the process with instructions to agencies that a lapse in appropriations has occurred and they should initiate orderly shutdown activities. That memo went out Tuesday evening.

The Congressional Budget Office estimates roughly 750,000 federal employees could be furloughed each day of the shutdown, with the total daily cost of their compensation at roughly $400 million.

What government work continues during a shutdown?

A great deal, actually.

FBI investigators, CIA officers, air traffic controllers and agents operating airport checkpoints keep working. So do members of the Armed Forces.

Those programs that rely on mandatory spending generally continue during a shutdown. Social Security payments still go out. Seniors relying on Medicare coverage can still see their doctors and health care providers can be reimbursed.

Veteran health care also continues during a shutdown. Veterans Affairs medical centers and outpatient clinics will be open, and VA benefits will be processed and delivered. Burials will continue at VA national cemeteries.

What Not To Do During a Government Shutdown

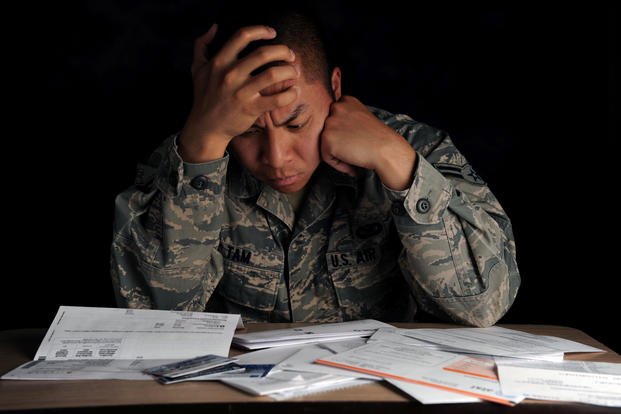

Panic seems like the natural response to the prospect of missing a paycheck due to a government shutdown. But a better idea would be to have a rational plan.

What steps can you take to survive a government shutdown and potential military pay delay?

- DO NOT take out a "payday" loan.

- DO NOT cash out your Thrift Savings Plan.

- DO NOT pawn all your valuables.

- DO NOT make any major financial decisions while under stress.

What You Should Do During a Government Shutdown

- If you're eligible, take advantage of resources like the Navy-Marine Corps Relief Society (NMCRS). This organization is ready to offer emergency financial assistance and resources to active-duty Navy and Marine Corps service members and their families. NMCRS can also offer guidance on working with banks and creditors and give general financial advice. For Coast Guard members, there is the Coast Guard Mutual Assistance (CGMA), which can provide financial assistance.

- DO make sure you have a thorough understanding of your current financial situation. Look at all available assets: checking, savings, CDs, etc. If you are unclear about what you owe and to whom, interest rates, minimum payments, and more now is the time to figure this out. Use this as a learning opportunity. If you have a partner with whom you share finances, talk with them.

- DO prepare to talk with any creditors, including landlords, mortgage companies, orthodontists, child-care providers, car finance companies, loans and credit cards. Their levels of willingness to help may vary, but either way, communication is essential. Get an idea of who is likely to work with you, and who won't be flexible.

- DO be prepared to suspend any scheduled automatic drafts. This process typically takes a few days.

- DO look at the choices you are making right now. Postpone all purchases that you can, whether large or small, including vacations, home repairs and renovations, and even small luxuries like that daily energy drink or fancy coffee. Get creative. What can you buy at the commissary instead of the convenience store? Might the $10 laundry detergent clean your clothes as well as the $17 bottle?

- DO control your food costs. For most families, food is the second or third largest expenditure after housing and vehicle expenses. Take an inventory of what you already have in your pantry, refrigerator and freezer. Think creatively about how to make this food last as long as possible. Search for recipes that call for the ingredients you already have. Learn to fill in with rice and in-season fresh vegetables. Can your family eat a few more meatless meals? Beans, which are extremely nutritious and filling, can be prepared dozens of ways and are also inexpensive, especially if purchased dried.

The Associated Press contributed to this report.