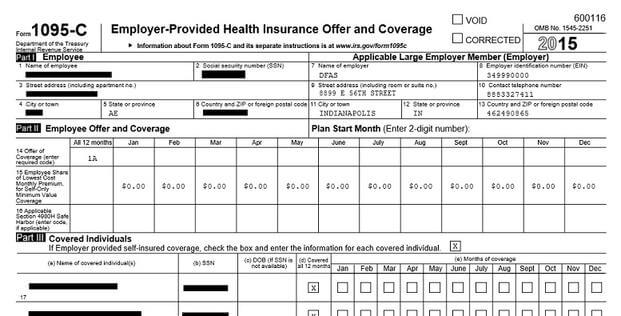

New for the 2015 tax year, taxpayers are required to have 1095 statements showing that they had Minimum Essential Coverage (MEC) for healthcare as required by the Affordable Care Act. I'm getting reports that people aren't getting their statements, or that their statements are wrong. DFAS makes it seem as if fixing 1095 tax statements should be pretty simple; I'm curious to discover what actually happens.

No Statement

Military service members, both active and retired, can access their 1095 forms through the MyPay online account access system. If you don't have a MyPay account, or you've locked yourself out of your existing MyPay account, I strongly encourage you to sort it out. MyPay is a valuable tool in tracking your pay, including tax withholding, allotments, and Thrift Savings Plan contributions.

Survivor Benefit Plan (SBP) annuitants who are covered by Tricare should be receiving their 1095B form through the regular mail any day now. They were all mailed by 1 February 2016, to the address you have provided in the Defense Enrollment Eligibility Reporting System (DEERS.) If your address in DEERS is incorrect, it must be updated on the MilConnect website or at a ID Card/DEERS office on a military installation. After the address is updated, a new form must be requested from the MilConnect website or by calling 800-642-1386. (If using the MilConnect website, you have to log-in, then select the tab that says "Correspondence/Documentation," then select "ACA-Corrected IRS Form. Once you get logged in, it's pretty simple.)

Incorrect Forms

If your 1095 Form shows incorrect information, you need to get it fixed. Unfortunately, it appears that can only be done via telephone. Contact a DEERS representative at 1-800-538-9552. I haven't don't this, but I would guess that there is probably a lengthy wait to get through to a person. I haven't been able to find any instructions for getting 1095 forms fixed at local personnel, finance or admin office.

While you don't have to submit your 1095 forms to the Internal Revenue Service (IRS) with your tax return, the Defense Finance and Accounting Service (DFAS) has reported the information contained on the 1095 to the IRS. Therefore, it is essential that your 1095 be accurate so that you are not penalized for not having MEC for the entire 2015 tax year.

For those of you who have errors, please let me know how the "fixing" process goes for you. Your experience can help others! Thank you!