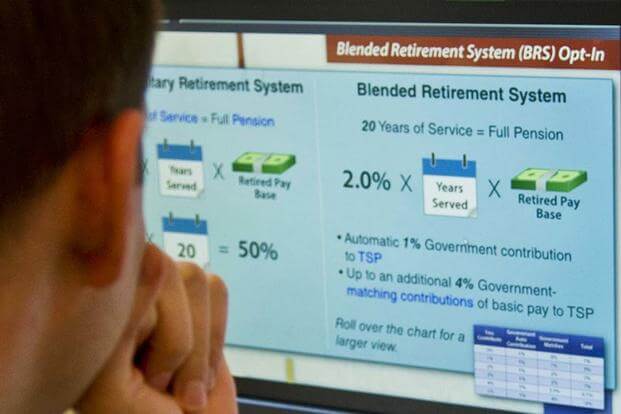

Just six and a half days until the military's new Blended Retirement System (BRS) goes live, and many people still aren't completely up-to-speed on what it is, how it impacts them, and whether they should make the switch. I'm here to encourage you to take some extra time this week to do additional training and reading to make sure you fully understand the new program. If you've been serving too long to have the option to switch, you'll be leading folks who are eligible, and they deserve accurate information from you.

To get you thinking and inspire your learning, here are a few pieces of misinformation I've heard in the last few weeks:

"I have to make the choice in January."

Service members who are eligible to opt-in to the BRS may opt-in at any time during 2018. However, if you are going to switch to BRS, there is a benefit to doing it early: Department of Defense contributions to your Thrift Savings Plan (TSP) account will start with the pay period after you switch. Switching early gives you more automatic and matching contributions.

"I'm not doing 20, so it doesn't matter what I choose."

Folks who aren't ever planning to serve until retirement are the folks who most benefit from a switch to the BRS. The biggest draw of BRS is that the over 80% of service members who don't reach retirement will leave with government-funded retirement savings.

"I did the mandatory training. Isn't that enough?"

No. The training is a good way to learn about the facts, but the training doesn't do anything to help you apply the facts to your specific situation. You really need to learn the facts, then mull it over, talk to the significant people in your life, and consider all sides of the situation. I've seen quite a few people flip-flop from their original BRS decision once they've had time to let the original information sink in, realize their questions, do further research, and learn even more.

If you're eligible to opt-in to the Blended Retirement System, it might be the most important financial decision of your life. Give it the time and energy it deserves and carve out the time to really learn the nuance of the two plans, talk it through with some smart friends and your nearest-and-dearest, and think clearly about the best choice for you.