When you join the military, the government automatically provides coverage known as SGLI and deducts premiums from your pay. But you can elect to decline this coverage and choose a policy through a commercial life insurance company or nonprofit organization.

Whether you choose the military's Servicemembers' Group Life Insurance or find your own, it's important to purchase a life insurance policy that will provide financial support in the event of an injury or death.

SGLI: Who's Eligible for SGLI

SGLI is a term insurance policy for active duty service members, Ready Reservists, National Guard members, members of the Commissioned Corps of the National Oceanic and Atmospheric Administration and the Public Health Service, cadets and midshipmen, and Reserve Officer Training Corps (ROTC) members.

SGLI: Coverage

SGLI also includes Traumatic Injury Protection (TSGLI). This coverage provides protection against loss due to traumatic injuries and is designed to provide financial assistance to members so their loved ones can be with them during their recovery from their injuries.

SGLI members can take up to $400,000 of coverage, in increments of $50,000 regardless of age. SGLI costs 6 cents per $1,000 of coverage. All SGLI participants must pay a $1 monthly charge for TSGLI, this brings the monthly premium to $25 for $400,000 worth of coverage.

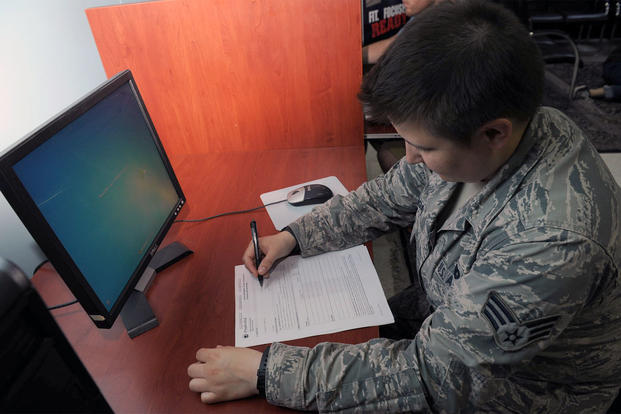

If you elect to be insured for less than the maximum amount or to decline coverage entirely, you must complete the Servicemembers Group Life Insurance Election and Certificate. This certificate -- which serves as a certificate of coverage -- designates one or more beneficiaries to receive payment of the insurance proceeds.

*Hot Tip: Coverage under this life insurance policy does not affect your right to retain any other government or private insurance, or your entitlement to other veterans' benefits.

SGLI: Coverage for Spouses and Children

If you and your spouse are both in the military and participate in SGLI, each of you can be insured under basic SGLI as well as SGLI family coverage for the maximum amount of $400,000 for each spouse. To ensure that both of you have spousal coverage you must list each other as spouses on your Defense Enrollment Eligibility Reporting System (DEERS) record.

SGLI: Family Service Members Group Life Insurance

If your spouse is not in the military the Family Servicemembers Group Life Insurance (FSGLI) might be a good option for insurance. FSGLI is an insurance plan for dependent spouses and children of active-duty service members who are covered by SGLI. FSGLI provides up to a maximum of $100,000 of insurance coverage for spouses and $10,000 for dependent children. However, you cannot purchase more coverage for your spouse than you have for yourself. For example, if you purchased $50,000 of coverage yourself, your spouse cannot have more than $50,000 of coverage.

SGLI: Coverage for Injuries

Under SGLI an active-duty, Ready Reservist, and reserve or guard member can be issued a traumatic injury benefit of between $25,000 and $100,000 if they sustain one these injuries:

- Total and permanent loss of sight

- Loss of a hand or foot

- Total and permanent loss of speech

- Total and permanent loss of hearing in both ears

- Loss of thumb and index finger on the same hand by severance at or above the metacarpophalangeal joint

- Quadriplegia, paraplegia or hemiplegia

- Burns greater than second degree, covering 30 percent of the body or 30 percent of the face

- Coma or the inability to carry out activities of daily living resulting from traumatic injury to the brain

Payments under this section may be made only if you are insured under SGLI when the traumatic injury is sustained, and when the loss results directly from that traumatic injury and from no other cause.

SGLI: After the Service

You will lose SGLI 120 days after you leave the service. Purchasing an individual plan of term insurance can ensure that you have coverage that goes with you when you separate or retire from active duty.

Upon your separation from service, you can convert your full-time SGLI coverage to term insurance under the Veterans Group Life Insurance (VGLI) program or to a permanent insurance plan with a participating commercial insurance company.

Veterans Group Life Insurance

VGLI is administered by the Office of Servicemembers Group Life Insurance but supervised by the Department of Veterans Affairs. You can buy coverage in increments of $10,000 up to a maximum of $250,000, but not more than the amount of your SGLI coverage -- $400,000 -- when you separated from the service.

In order to convert an SGLI plan to a VGLI plan, you must submit an application to the Office of Servicemembers Group Life Insurance with 120 days of separating from active duty. VGLI will become active on the 121st day, or on the day the premium is received in the SGLI office.

*Hot Tip: You can participate in both plans if that is somehow advantageous, as long as the combined amount of SGLI and VGLI does not exceed $200,000.

SGLI is just the tip of the insurance plan iceberg. There are several other plans designed to protect a service member's family and finances in the event of a traumatic injury or death. Read more on Military.com.

SGLI and VGLI May Not Be Enough

SGLI and VGLI may not be enough to cover your family's needs. Explore life insurance options with our free tool that compares rates and matches you to the coverage your family needs.