The military made major changes to its retirement system on Jan. 1, 2018, adding the Blended Retirement System. Let's look at what it means for military members.

What Is The New Retirement System?

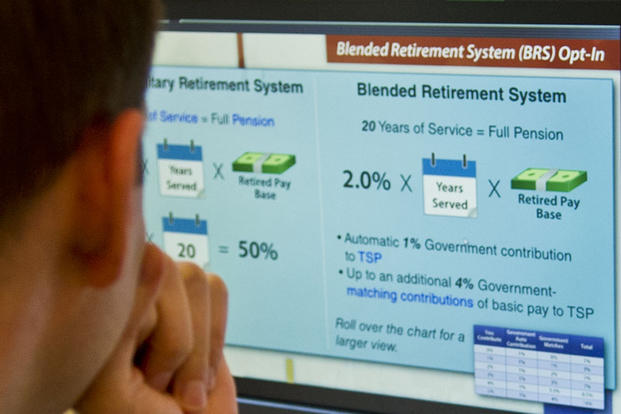

The new retirement system is known as the "Blended Retirement System" or BRS. The “blending” in BRS comes from the blending of two major sources of retirement income: the existing annuity provision for those who retire after 20 or more years of service, PLUS the Thrift Savings Plan (TSP). The TSP is a government run 401(k) retirement account that allows members to invest their own money in either stocks or government securities and also get a contribution to that account from their employer.

What Is New About This Retirement System?

BRS uses the retirement annuity formula that has been in place for years: the average of the service member's highest 36 months of basic pay times 2.5% of their years of service -- but the 2.5% is adjusted downward by half of a percentage point, from 2.5 to 2%.

To make up for this reduction the government will contribute to a member's Thrift Savings Plan (TSP).

After the first 60 days in the service, all members are enrolled in TSP and receive an automatic government contribution of 1% of basic pay into their account each month. This 1% contribution is automatic, you don't have to put any of your own money in to receive it. Additionally, members are automatically enrolled to contribute 5% of their out-of-pocket basic pay to the TSP each month (they can change or stop this at any time).

After two years of service, the government will match the member's contributions up to an additional 4%. So, after two years of service, members can get up to a 5% government matching contribution on top of what they contribute each month. Therefore if a member contributes 5% of their basic pay the government will match it, making a total contribution to the TSP of 10% of their basic pay.

If a member only contributes 3% of their basic pay to the TSP, the government matching contribution will be 3%, and so on. If a member has the ability to contribute more of their basic pay to the TSP - say 10% - the government will still only contribute a maximum amount that equals 5% of the member's basic pay.

For an E-4 with 4 years service contributing 5% of the basic pay that equals over $3,000 being saved each year. Compound those contributions and interest over several years and you are talking serious savings -- hundreds of thousands of dollars over a military career!

Why Is Adding The TSP To Retirement A Good Thing?

The best part of having a TSP contribution really applies to those who don't stay in the military long enough to get a retirement check.

The government says that 83% of people who join the military don't stay long enough to retire, so when they leave after 5 or 10 years of military service they basically get nothing towards their future retirement. This plan changes that.

By contributing to the TSP, military members can leave the service at any time and have an existing retirement fund that they can take with them anywhere. Even if they get out of the military before completing 20 years they would keep the money they have in their TSP fund. That money can be left in the TSP, taken out, or moved to a different retirement fund to get tax savings.

What Else Is New About the Blended Retirement System?

Continuation Pay

BRS also includes a mid-career continuation pay at about 12 years of service, as a further incentive to convince military members to remain in the service until they reach the 20 year mark and qualify for monthly military retired pay. The amount, length of addition service required, and actual time payable differ for each branch of service, in some cases different military occupations get different amounts too. Check with your personnel office for specific details.

Related: Continuation Pay Explained

Lump Sum Option

When you retire (or at age 60 for guard/reserve members), you will be given the option to receive monthly retirement pay checks, or you can take a lump-sum payment of either 25% or 50% of your gross estimated retired pay, and get smaller monthly checks.

If you take a 25% lump-sum payment, your monthly retirement pay will be 75% of the normal full retirement pay. If you take the 50% lump-sum, it will be 50% of the normal retirement pay.

Also, your lump-sum payment is discounted by an amount that changes every year. For 2023 this discount rate is 6.32%. That means that if your total retirement is determined by your finance office to be $100,000 you would only receive $93,680 (100,000 discounted by 6.32%). Also, the lump sum payment is taxable.

When you reach age 67 your retirement pay goes back up to the full amount if you take either lump-sum option.

The Blended Retirement System Summed Up

The new system is made up of 4 specific components:

- Defined Benefit:

- Retired pay will be 2% times number of years of service. If you retire at 20 years service you get 40% of your final base pay. If you retire at 30 years service you get 60% of your final base pay.

- You can either get your full retirement when eligible or opt to get a lump-sum benefit at retirement. If you take the lump-sum you will get a reduced monthly retirement check until age 67.

- Defined Contribution:

- The military will contribute 1% of your base pay to your TSP no matter what you do, even if you don't put any of your own money in

- You will be automatically enrolled with a 3% base pay contribution to your TSP. (You can change this at any time.)

- The military will match up to 5% of your contribution after 2 years of service.

- You can always stop contributing to the TSP, get a loan of your TSP balance, or withdraw your money from the TSP account.

- Continuation Pay:

- When you reach 12 years of service and commit to 4 more years of service you will be eligible for a cash incentive of 2.5 to 13 times your regular monthly basic pay if you are active duty and 0.5 to 6 times your monthly basic pay if you are in the reserves.

- Choice of lump sum payment

- If you take a lump sum payment it will be discounted to allow for inflation.

- If you take the lump sum payment, your monthly retirement benefits (and survivor benefits) will be reduced.

For More Information About The Blended Retirement System

DFAS has several resources that explain the BRS on their website. Members should also receive BRS training at their units. The DOD also has a BRS calculator online.

Keep Up With Military Pay Updates

Military pay benefits are constantly changing. Make sure you're up-to-date with everything you've earned. Subscribe to Military.com to receive updates on all of your military pay and benefits, delivered directly to your inbox.