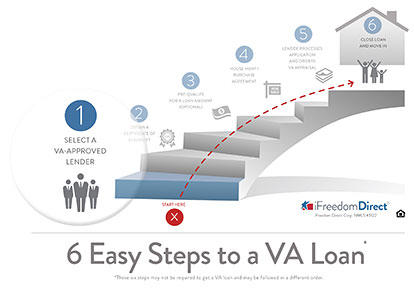

Following 6 easy steps to a VA mortgage can prevent confusion and delay. Learn the DOS and DON’TS of the first step: picking your VA-approved lender.

The VA mortgage process can seem hard at first. But, if you take it one step at a time, you could be a homeowner sooner than you think. A VA mortgage can be up to a 30-year commitment, so the terms of your loan need to match your financial goals. Choosing the right VA-approved lender can make a big difference in your mortgage experience and outcome.

To help you with this important first step toward homeownership, here are some “dos” and “don’ts” to consider when selecting your lender.

1. DO make sure the lender is VA-approved.

Not all mortgage lenders have approval from the VA to originate and fund loans backed by the U.S. Department of Veterans Affairs. If you plan to use your home loan benefits, the lender you use must be VA-approved. That’s a basic requirement. To find out if a lender meets that criterion, be sure to ask if they originate VA home loans before you start the application process. If you skip this step, you may end up well into the mortgage application process before you find out that a VA loan isn’t an option with your lender.

2. DO ask the loan officer if he or she services VA mortgages on a daily basis.

Asking this one question can separate the occasional VA lender from one that specializes in VA loans. Many approved lenders originate a variety of mortgage loans, with only a very small ratio of them being veterans’ loans. A specialist makes VA loans day in and day out. Although any approved lender can process your loan, one that intimately understands the lender’s guidelines may be able to achieve success where other lenders may fail.

3. DO read the warning signs.

Certain red flags could indicate that your lender may not be as experienced in these government-backed loans as you’d like them to be. Here are some warning signs to look for:

- You’re not asked about your military service

- You’re steered away from the VA home loan benefits you’ve earned

- VA terms like “entitlement” and “eligibility” don’t roll off the loan officer’s tongue

- The loan officer doesn’t know basic VA guidelines by heart

- You get “I’m not sure” when you ask basic questions about your benefits

4. DON’T assume all VA-approved lenders are the same.

Not all VA-approved lenders are created equal. Some are more experienced in serving veterans than others. VA loan specialists process VA loans on a daily basis. The loan officers are very familiar with the guidelines and, more often than not, handle special situations unique to the military community. These can include repeat use of home loan benefits, frequent relocations due to PCS and military retirement. One way to gauge experience of a VA-approved lender is to look for good ratings with reputable organizations like the Better Business Bureau. Another is to consider the number of years in business.

5. DON’T believe everything you hear.

Misconceptions can get passed along when someone is not 100% informed about the VA Loan Guaranty program.

These myths – that the VA loan process takes longer than other loans; that multiple VA loans aren’t possible; that you can’t buy a home while overseas – keep eligible borrowers from using their hard-earned benefits.

In reality, you may be able to use your VA home loan benefits over and over again, and, in certain situations, it’s possible to own two homes at a time. Interest rates are competitive with national rates, approval requirements are generally straightforward and there are exceptions to the occupancy guidelines if you are serving overseas. If you’ve heard something that doesn’t sound quite right, you may want to get a second opinion.

6. DON’T be strong-armed into a choice.

Have you ever been told that if your credit is pulled by more than one lender while shopping for a loan that it will hurt your score? Equifax, one of the major credit bureaus, explains on its website that in most cases it won’t.

According to the bureau, most credit scores are not affected by multiple inquiries from mortgage lenders within 30 days. In such cases, the multiple inquiries are treated as a single inquiry, having little or no impact on your credit score.

If you are feeling pressured early in the process to make a decision about a lender, know that it is your option to investigate the loan products and services of more than one company.

A good lender offers honest advice, a decent rate, reasonable fees and excellent customer service. Home loan benefits are earned, and a reputable VA-approved lender can help you understand what they are and how to use them. Contact a VA loan specialist today.

Ready to Get Started?

If you're ready to get started, or just want more information on the process, the first step is to get multiple no-obligation rate quotes. You can then discuss qualifications, debt to income ratios, and any other concerns you have about the process with the lenders.