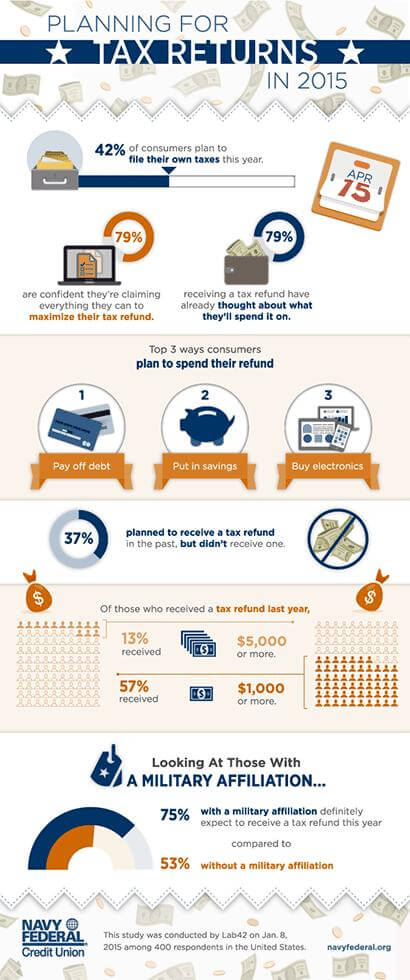

As you prepare your tax return this year, plan ahead. Will you be getting a refund and how will you use that money? According to a study conducted by Lab 42 for Navy Federal Credit Union, 75% of consumers with a military affiliation are expecting a tax refund this year. The top three ways consumers plan to spend their refund is to pay off debt, put in savings or buy electronics.1

If you plan to splurge with your refund this year, here’s a small dose of reality. A tax refund isn’t free money. It’s money you already earned that has been languishing in Uncle Sam’s coffers instead of earning interest in yours. You worked hard for that money, so let it work for you now.

Here are four ideas that you may want to consider when deciding how to use your tax refund this year:

- Pay down debt. If you owe money, you probably pay interest. If you’re paying interest, you’re losing money. Stop losing money. Eliminate or minimize debt to reduce the interest you pay. And, once you pay off the debt, you’ll have more money in your pocket.

- Start an emergency fund. It’s not an exciting option, but a job loss, car repair or furnace replacement will dramatically increase your appreciation of that cushion. Try to keep at least three to six months’ worth of expenses, so you can absorb costs if you lose your job or have a major expense.

- Educate your kids.If you have children, college tuition may be on the horizon. Putting your tax refund into a savings plan makes sense (and dollars). If you put $3,000 in a 529 education plan now and it earns average returns of 7 percent, it will be worth $4,252 in five years, $6,028 in 10 years and $8,546 in 15 years, even if you add nothing more to the account.

- Plan for retirement. Put your refund into a traditional or Roth IRA, if you’re eligible. You can contribute $5,500, or $6,500 if you’re 50 or older. With even just a one-time contribution of $2,000 at an average annual rate of return of 7 percent, in 20 years, you’ll have more than $8,000.2 Imagine what could happen with annual contributions.

Check out this infographic for more tax return statistics and see where you stack up.

1According to a 2015 Survey conducted by Lab 42 for Navy Federal Credit Union. The respondents of the survey are not members of Navy Federal and included military and non-military.

2Withdrawals from a traditional IRA prior to age 59½ may be subject to ordinary income tax and a 10 percent tax penalty. Withdrawals from a Roth IRA are tax-free at retirement if the account holder is at least age 59½ and has held the account for at least five years. Premature withdrawals are subject to ordinary income tax and a 10 percent tax penalty.