Every so often we face a mental impasse that seems impossible to overcome. You're chugging along just fine and all of a sudden your brain decides, "Optimism, thou shall not pass." It's a quick, hard brake on momentum and it can be incredibly frustrating.

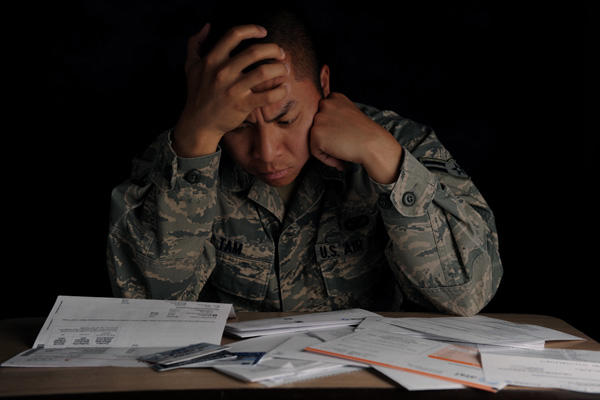

So what happens when you run out of steam for your financial goals? It's rough, to say the least. With burnout comes exhaustion and frustration and (more than) a little guilt. But it's also an expected part of the cycle of any long-term goal or routine and you should be confident in knowing that you'll overcome the challenge.

Here's how to re-energize when you feel like you've reached the end of your rope:

Acknowledge the fact

First things first – acknowledge your burnout. Trying to ignore or deny the stall will only prolong the time it takes to get back on track. It's not always easy to admit a challenge, but it's a part of the path to success. You haven't been defeated – you're just surveying what's next. Success isn't about being perfect, it's about knowing how to make adjustments that result in positive growth.

Brainstorm potential causes

There are many reasons why you may be hitting the proverbial wall. Here are a few possibilities:

- working too hard

- feeling at a loss for new ideas

- unmotivated

- fearful of success

- fearful of failure

- feeling lazy

Honesty is key here. For instance, "feeling lazy" is a common and completely acceptable reason for a burnout – you shouldn't feel guilty. When you acknowledge the cause, you you're that much more empowered to take it on and find fixes. Additionally, you're much more likely to find out specific ways to deal with it efficiently.

Differentiate between burnout and boredom

Both are legitimate reasons to take a step back from your financial approach but they aren't exactly the same, either. Boredom might be cured from trying something new or redirecting your attention to another area of your finances in order to regain some of your momentum. Burnout is a little more deeply rooted than that. It includes feeling apathetic and in some cases – hopeless. For most people who experience burnout they've already gone through the stages of boredom and need more than a new idea.

Set a new bottom line

Make it relatively simple. Reassess your goals to figure out if they continue to be realistic for your financial needs. One of the reasons that burnout can feel so frustrating is that it seems like there are so many solutions out there. With all the info, shouldn't we be able to find something? But the vast amount of resources is a double edged sword. Yes, we have access to solutions, but we can also paralyzed by the oversaturation. So instead of relying on someone else to guide you/tell you your bottom line, create a personalized bottom line that you genuinely think meets your abilities and needs. This will at the very least give you something that is crafted just for you, instead of trying to fit an edge piece into the center of your financial puzzle.

Imagine that you've already succeeded

Will you be happier or worse off for making a positive change? It's not meant to be a trick question, just one that more or less shows you that efforts made to learn and grow is almost always worth the energy. It's a little in line with the saying, "you never regret a workout," because of the way that it energizes you and keeps you fit. Even still, it takes discipline and pep talking to leave your bed in the morning to go hit the gym. The same goes for completing a financial project or task. Think about how you will feel once it's done instead of how much you don't want to do it.

Make a list of what's working

We get super caught up with what's not working but there's a ton of value in focusing on what is working. The small irritations or failures tend to take attention over the incredible number of wins (however small) we experience. Don't gloss over what's been working in your financial plan (such as "I haven't spent money on clothes in 7 months"). The things that you've already created or succeeded in are great resources. Unpack the hows/whys of the success and try and pinpoint a few elements these successes have in common. For example, my list would look a little like this:

- I consistently work best in the morning and in the late afternoon so I've created a schedule that works with my efficiency

- I follow through with financial goals when there's added accountability

- Thinking about food and travel goals consistently helps be to regain financial focus

Write down your number one goal – and brainstorm detailed steps to achieve it

Brainstorm ideas and write them down. Even if you know that you're nowhere close to actually doing them, writing down your ideas is a great way to at the very least get out some thoughts that may spark other thoughts. Get as crazy as you want and open up your brain a little bit. Finance is often very cut and dry but ideas are anything but. Do you want to buy a farm in the middle of Kentucky and start your new life as a farmer? How would you make it happen, etc. Be as specific as possible.

Read people who inspire you

Creative thinking begets creative thinking. Go ahead and let your mind surf over the ocean that is the internet. Yeah – no bars held back on the nerd scale. Read financial bloggers, research things that interest you, most importantly – make it your mission to learn something and then dive in headfirst. You'll gain fresh perspective and push yourself beyond the limits of your current habits or routines.

Start out by doing just one thing

Do something you know you can accomplish – even if that's just putting a dollar bill in a jar. On the tail end of a burnout it's difficult to scale back when you've set (and accomplished) a fairly high standard of success. But when you are facing burnout you're essentially in recovery mode. If you ran a marathon, you wouldn't set out for another 26.2 miles the very next day. You need to cater to your mental fatigue and give yourself a little bit of TLC as you work up again to your previous level of motivation or sustainable effort.

Treat apathy as a learning experience

Last but not least – be nice to yourself. Know that sometimes you're going to fail miserably, or experience a complete lack of motivation when it comes to your finances. It's important to think of apathy or burnout as a temporary detour. Yes, it takes you away from where you were headed but you will ultimately end up back on the main track. When you incorporate the reality of these occasional meanderings, you map out a plan that is realistic and sustainable.

Claire Murdough is a personal finance writer for ReadyForZero, a company focused on helping people pay off debt. She is a Bay Area native with an affinity for travel and food who enjoys writing about how to get out of debt and many other topics. You can keep up with her on Twitter @ReadyForZero.