What can you remember, right now, about your high school economics class? When were you taught about calculating taxes? Where was the chapter on creating and maintaining a budget? For most of the U.S., these topics were never covered in high school, and the best financial education you received came from your parents. While there are undoubtedly personal finance gurus out there, most folks are underprepared, and this deficiency is hurting military families in a big way.

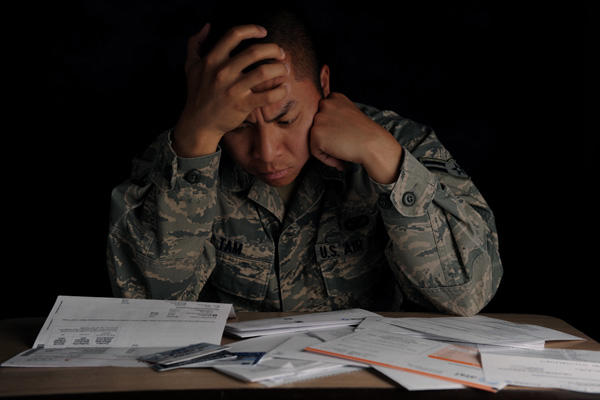

As though the current U.S. economy wasn't bad enough, a recent questionnaire from the National Foundation for Credit Counseling (NFCC) revealed a general emergency: the majority of service members and their families are financially unprepared, and are caught in vicious, destructive spending cycles.

Military.com had the chance to speak with Gail Cunningham, chief spokesperson for the NFCC, and Neal Urwitz, spokesman for Pioneer Services, which partnered with NFCC to produce the survey, about the problem.

Gail: Our takeaway certainly was that the military does a good job of making the point that their expectations are high when it comes to financial responsibility for their service members. To an extent, the service members said that they had a good grasp of financial literacy. But when we drilled down a bit, we discovered that more than half, 77%, have financial worries. That was a concern.

Then we found that it's trending in the wrong direction: 28% are now more worried than they were twelve months ago about their personal financial situation.

One obvious cause of this could be some of the military cutbacks. 55% of the military respondants in our survey indicated that they are indeed financially ill prepared for an emergency. When that happens, it thorws everyone into a financial tailspin because you're left with poor resolution options. A potential emergency or unplanned expense requires your full attention. It could be something like a flat tire or home maintenance.

Service members have been turning to credit cards to satisfy that expense, adding to an already existing debt load. Or perhaps they borrowed from friends and family and that's at best awkward. Or maybe they take money from a high priority, such as their rent or medicine or daycare. That really starts a downhill spiral.

Neal: Or that goes to a payday lender. One of the things that we were talking about, that 60% have taken non-traditional loans and 60% have credit card debt that they carry over month to month.

Gail: When we looked at the military population against the general population, we found some red flags. Twice as many service members applied for a credit card in the last twelve months, and that can really indicate that you're desperate for money. People sometimes who apply for new credit or those who have maxed out their existing credit are living beyond what their income can support. The only way they can move forward and hope for any financial stability in their lives is to have access to new credit. But that's just going to add to their existing debt load.

Twice as many military folks as the general population have paid the required minimum payment on their credit card in the last twelve months. Again, sure your servicing the debt but at the bare minimum. You're just paying the minimum monthly payment and you're continuing to charge and interest is added on to the existing balance. When you get your statement in the mail next month, guess what: it's higher.

These were some of the red flags that we called out of the survey, and we felt that, taken in totality, there is a lot of room for military members to increase their financial wellness.

Neal: Without some sort of interjection, this is going to get worse before it gets better. There are so many military benefits that are on the chopping block. You've got the commissary benefit, military tuition assistance, housing and moving stipends. They all look like they're going to be cut. Since military families move so often and that might qualify as a financial emergency where they need capital, individual military families are going to get in a lot more trouble.

There is a real readiness issue here. When you have financial trouble, you don't forget about that while you're at work. When we cut 100,000 jobs from the Army alone, we're going to end up with fewer people taking on more responsibilities, and when you have quite a few in financial trouble, they'll be distracted at work or leave the military than they otherwise would. When you have that, you lose your experienced people. Your readiness goes down. You have distracted workers? Your readiness goes down.

Gail: Debt concerns are with you 24/7. You take them to bed with you, you wake up with them, and them to work with you. I think the last segment of the population that we want to be distracted would be our military. They're undergoing enough challenges and sacrifices serving our country, and financial concerns should not be one of them.

Neal: Because of who the military population, particularly the enlisted, tends to be, there's a gap in our financial system for them. Nineteen, twenty, twenty-one year olds may be married, may have their first kid, but are hardly well established. They're not getting the USAA loan, particularly not if it's not attached to a car or a house or something. They don't have a whole lot of alternatives. That's why 55% feel like they are unprepared for a financial emergency. There aren't many places for them to go – there are basically payday loans. There is a big gap in the market. It would be useful to have that addressed.

Are service members usually living beyond their means, or do they not have the resources necessary to make ends meet?

Gail: Door number three would be that they don't have the financial education to make responsible spending decisions.

Neal: When you're in your early twenties, you just don't know all that much about finances. It takes a little while to learn, and you need to have a place where you can go to education yourself. There's no shame in asking for more financial education.

Gail: We do have the NFCC at about 600 locations coast to coast. If someone wants to sit down across a desk form a financial professional, they can certainly do that. We offer counseling by phone or even internet. Those who are deployed don't have to feel like their hands are tied just because they're out of the country. They can still get excellent advice and solutions to their financial concerns.

What's the best way to deliver the education that they need?

Gail: There are a few ways. Less than half of high schools in the country include personal finance courses as a requirement for graduation. If we think that young people are coming out of our school system with a solid grasp of financial literacy, I think we're mistaken. Our survey shows that the majority of folks learn financial advice from their parents. That sounds nice until you realize that 40% of the population gave themselves a C, D, or F on their financial literacy. The parents may not have the best financial skills to be imparting to their children. The third option is an NFCC program called "Sharpen Your Financial Focus" which has a strong military component. You can go there today and at the top you'll see a Military tab There you'll find information for any stage of your military career, whether you're newly enlisted or transitioning out.

In our culture, we have a "pull yourself up by your bootstraps" mentality. So often we resist reaching out for help, and at the NFCC we find that mentality is detrimental to people beucase they continue digging their financial hole until it's difficult to resolve. When someone comes to an NFCC member agency, we will triage them. If they have an emergency, their house is going to be foreclosed on for instance. That will be addressed immediately. But we also look at their long-term needs and goals. Where do they see themselves three years from now? Five years from now? Let's get you on solid financial ground for the future.

What can veterans and service members do to bring themselves out of a financial emergency?

Gail: I think financial buildings blocks of getting your credit report. We asked in our survey if people had accessed theirs, and the strong majority of people, in spite of their report being free from annualcreditreport.com, do not access it. Why is that a big deal? Because your credit score, those three little numbers, is based on the contents of your report. You look at your report and its your financial finger print.

The second thing that people can do, but people resist, is to track your spending. You can't know where you're going unless you know where you are. I would like for people to write down every cent they spend for thirty days. You can do anything for thirty days. If I asked what your rent and car payment are, you'd tell me. But if I asked how much you've been spending on eating out, you'd be surprised. It's the little purchases that add up, creep up, and dig us into a hole.

Thirdly, become financially organized. The NFCC member agencies see more than 1.5 million people each year. A disturbing number of them walk into our offices with huge stacks of unopened bills. That is not the definition of being financially responsible. I'm not saying you have to have a full blown home office, but open your mail the day it comes, create a financial center, and there is no reason to ever pay a bill late and incur a late fee and a ding on your report.

Neal: The resources, particularly for military families, exist to get financial counseling. Take advantage of it. It's usually free.

The current situation is bad. That, I think, needs to come across quickly. There is really a problem here. This is not low-priority, this is a problem.

Gail: We have solutions. Not only advice, but solutions to everyday questions and concerns.