VA guidelines do not mention a minimum credit score, but VA lenders have their own requirements. Find out what the industry standards are for VA loans and why this score can differ from lender to lender.

Juan Chavez married his high school sweetheart, Desirae, while still in his teens. At his wife’s urging, Juan joined the US Marine Corps.

The young couple spent much of their first decade of marriage moving from one place to another, and often living apart. Between three active duty tours in Iraq, they managed to have three children.

Juan served his country for a total of 13 years. When he completed his service, all Juan wanted was to provide a home for his family. Choosing to use the zero-down-payment home loan benefit he had earned was easy. But when he applied for a VA loan with the bank he’d been loyal to for over a decade, Juan was turned down.

Rather than give up, Juan approached another lender and was approved.

“Juan was the ideal borrower,” said Jan Davis, Juan’s loan officer with Veterans First Mortgage. “He had established steady income, and he had very little debt or major blemishes [on his credit] to speak of.”

It came down to credit score. Juan’s was well above the industry standard of about 620, but the first lender had set its requirement much higher — out of reach for Juan. As he would learn, however, loan qualification guidelines can vary by lender.

While standards can vary, all lenders look at credit score, income and debt-to-income ratio of potential borrowers.

Read Juan’s full story here.

Why Credit Scores Matter for VA Loans

Your FICO® score is just one part of VA loan qualifying. Approved lenders typically screen borrowers upfront by asking about their credit.

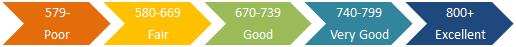

FICO scores can range from 300 to 850. The average FICO score for VA loans closed in July of 2016 was 709, according to Ellie Mae’s Origination Insight Report.

Graphic, provided by Veterans First Mortgage®, shows credit score range according to FICO®

Minimum Credit Score for VA Home Loans

VA guidelines don’t mention credit scores because it is the lender’s responsibility to determine whether borrowers have the ability to repay their home loans. For most VA lenders, the minimum qualifying score is in the low-to-mid 600s.

TIP: If your score is in the 600s and you’re turned down for a VA loan, it may be time to try another VA lender.

According to the Federal Reserve, things that can bring your score down include opening up new credit accounts, late payments, loan defaults and too much debt, to name a few. It’s important for borrowers not to do things that will hurt their credit when applying for a home loan.

When One Lender Says No, Another May Say Yes

Today, Juan and Desirae and their three kids are enjoying civilian life in their beautiful new home in Indiana. Despite being turned down by their first lender, they put their trust in another lender and got the results they wanted.

“The best part about owning a home is planting your roots,” Juan said, “growing old with your neighbors, and having your kids grow up with the same friends. If I would say anything to Veterans First, I would say thank you from the bottom of my heart and my family. We love our new house."

Ready to Get Started?

If you're ready to get started, or just want to get more information on the process, the first step is to get multiple rate quotes with no obligation. You can then discuss qualifications, debt to income ratios, and any other concerns you have about the process with the lenders.